In South Africa, getting funding for small businesses is key, especially after COVID-19. At Track It All Software Solutions, we know the hurdles entrepreneurs face. Our country’s entrepreneurial spirit is strong, but many young entrepreneurs find it hard to get the funds they need. Banks often see these ventures as risky, so many look for other ways to fund their ideas.

Using crowdfunding, microfinance, and government grants is crucial for getting the capital we need. For example, the Agro-Processing Support Scheme (APSS) gives a R1 billion grant to help grow the agro-processing sector. The Black Industrialists Scheme (BIS) also offers grants of 30% to 50%, up to R50 million, helping ambitious business owners.

The Green Energy Efficiency Fund (GEEF) gives loans of R1 million to R50 million, mainly to companies earning less than R51 million a year. Knowing about these options is key for those looking to finance start-ups. We must explore these funding sources to help South African businesses grow financially. For more on improving your HR functions, check out our HR management systems page.

Key Takeaways

- Looking at different funding options can greatly help your business succeed.

- Grants like the APSS and BIS offer big financial support for eligible businesses.

- Crowdfunding is a great way to raise money with help from your community.

- Microfinance is good for smaller projects needing less money.

- Talking to your customers can lead to new support and funding chances.

Understanding Different Avenues for Funding

Exploring funding options is key for entrepreneurs wanting to grow their micro businesses. In South Africa, there are many ways to fund your business, each suited for small businesses. We can look into loans, grants, and private investments, each with its own pros and cons. Knowing these options helps us make smart choices for our financial future.

Types of Business Funding Available

When looking at investment for micro businesses, we should check out the funding types available. Here’s a quick look:

| Funding Type | Description | Repayment Required |

|---|---|---|

| Government Grants | No repayment, aimed at economic development | No |

| Loans | Funds borrowed with interest | Yes |

| Angel Investment | Private funding from high-net-worth individuals | Yes (often with equity stake) |

| Venture Capital | Investment from firms in exchange for ownership | Yes (equity) |

Most businesses in South Africa start without any financial help. Loans are a popular way to get financial support for SMEs, but they need collateral and good credit. On the other hand, grants are great for start-ups as they don’t need to be paid back. They focus on helping the economy grow, especially for groups that have been disadvantaged.

Government Grants for Small Businesses

There are many grant opportunities for small enterprises in South Africa. For example, the National Youth Development Agency gives funding to young entrepreneurs aged 18 to 35. The Isivande Women’s Fund helps women entrepreneurs, and the Black Industrialists Scheme offers grants up to R50 million for black-owned businesses.

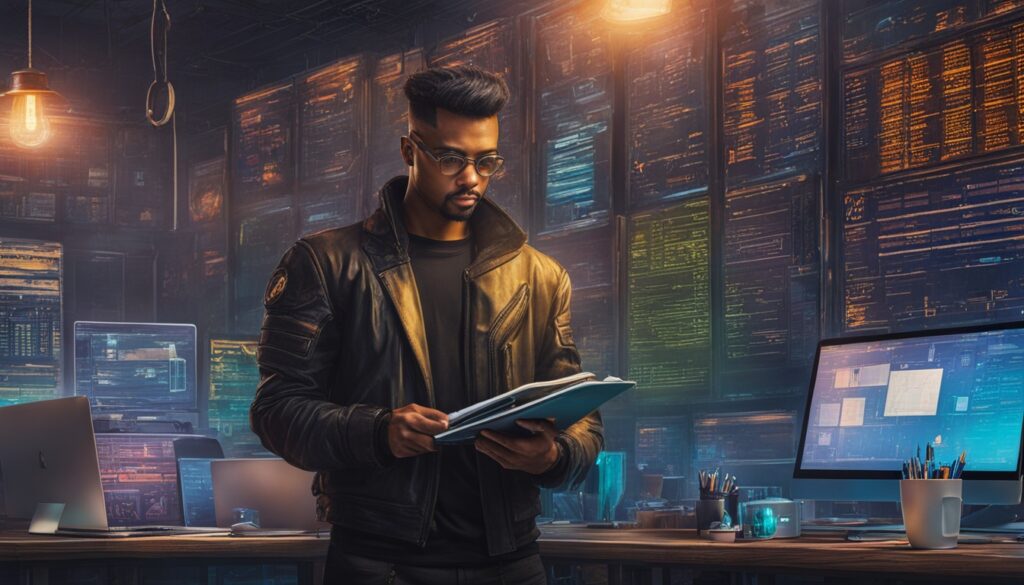

To get these grants, we need to match our proposals with the government’s goals. We can get help from the Small Enterprise Development Agency (Seda) and Khula Enterprise Finance Ltd. They assist with grant applications and business planning. Using tools like logistics management systems can also help us improve our business plans for funding.

Funding Small Business Enterprise: Strategies to Secure Finance

Exploring funding for small businesses reveals several strategies to secure finance. These include Crowdfunding, Microfinance, and getting financial support from customers. By using these methods, we can lay a solid financial base for our ventures.

Crowdfunding as an Alternative

Crowdfunding is a strong way to get start-up capital. We can use online platforms to connect with people who want to invest for equity or rewards. In South Africa, platforms like Uprise.Africa and Jump Starter help those who don’t fit traditional funding criteria.

To draw in investors, we must make clear, engaging pitches. These should explain our business and how their money will help.

Utilising Microfinance Options

Microfinance is great for getting small, unsecured loans. It’s perfect for new and minority-owned businesses. The South African Micro Finance Apex Fund (Samaf) helps rural and marginalised entrepreneurs with tailored financial services.

This option gives us flexibility in getting funds. But, we must plan carefully for repayments, which may include interest. We can look at various microfinance institutions to find the right one for us.

Engaging with Customers for Financial Support

Asking customers for funding is a less common strategy. By building strong customer relationships, we can ask for financial help. This could be through discounts or shares in our business.

This approach can bring in cash quickly, helping us invest back into our business without high-interest loans. It also builds customer loyalty and encourages ongoing support. By having a steady flow of cash and loyal customers, we can continue to grow and expand our product offerings. Additionally, the benefits of inventory management software can help us streamline our operations, reduce holding costs, and improve overall efficiency. This allows us to have better control over our inventory, further increasing our ability to meet customer demand and maximize profits.

Learning about all funding options in South Africa, like government grants and private financing, can improve our funding strategies. Knowing how to use these resources well will help us grow our businesses.

Conclusion

Getting funding for small businesses like Track It All Software Solutions is tough and complex. We have to look at different funding options, like government grants, crowdfunding, and microfinance. With just 12% of small businesses in South Africa getting formal funding, we need a smart and thorough approach.

It’s key to make strong applications and set clear financial goals. Since 62% of small business owners struggle with funding, knowing how to use these resources well can help us grow and stay ahead. We also need to watch out for big companies and rising costs due to inflation.

By being resilient and finding new ways to solve problems, we can overcome finance challenges for start-ups. This helps our business survive and grow. It also helps the economy of South Africa, making sure our small business does well even when things are tough.